In February, I posted: Middle-Aged Man on Rent vs Buy. I discussed how rent vs own ratios were way out of whack in many markets. I featured this handy calculator to compare renting vs buying.

Recently, I played with the Rent vs Buy Calculator to compare the financial consequences of my current rental home vs a nearly identical home just a few houses down the street that went under contract for sale. I expected to see that in the short-run, renting would come out ahead financially. I was correct on that. I also expected owning to come out ahead, but not for a long, long, long time from now. On that latter point, my expectation was incorrect.

What I discovered was that it would not take a long, long, long time for owning vs renting to come out ahead, financially. Rather, what I calculated in this example was that owning would NEVER come out ahead of renting. As the calculator summarized it: “Buying will never be cheaper than renting.”

Wow. That’s messed up. Buyers Beware! Use the Rent vs Buy Calculator to compare the situation in neighborhoods that interest you. And read this article, too:

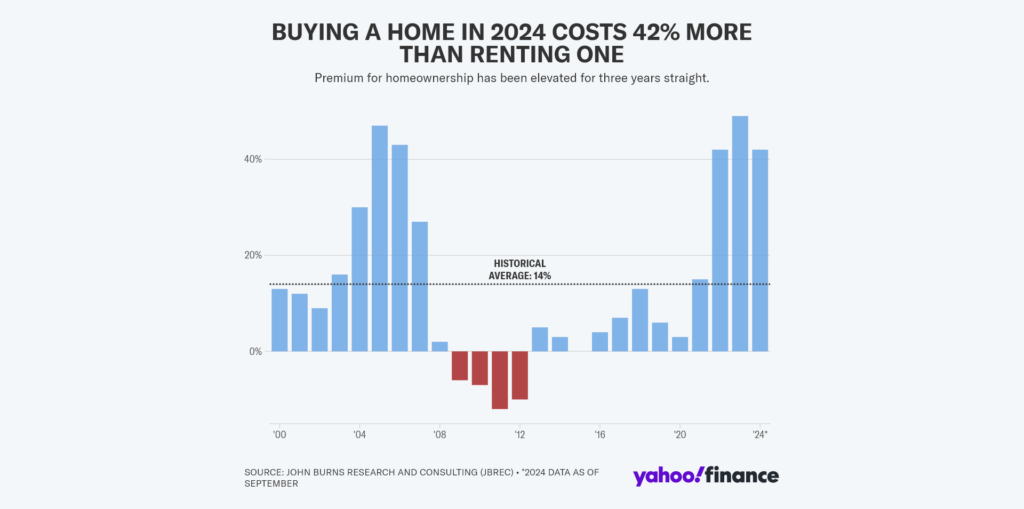

Owning a Home has Rarely Been This Much More Expensive Than Renting. Claire Boston · Senior Reporter, Updated 11/23/2024

The article contains this ominous bar chart, republished here under the fair use doctrine. Look at the last time the rent vs own ratio was about as extreme: 2004 – 2007. Remember what happened to home values after that period? That’s right, they plummeted. I am not arguing causation–there were a lot of factors and correlations at play back then just as there are now. However, I am pointing out one of many warning indicators in our current times that demands inquiry by anyone considering purchasing a home, depending on their circumstances and goals. At any rate, enjoy the article!

With Love,

P. Gustav Mueller, author of The Present